Risk Contagion Effects of Interconnected Manufacturing Enterprises

Energy Systems Structural EngineeringData EngineeringReceived 28 Aug 2024 Accepted 05 Sep 2024 Published online 06 Sep 2024

ISSN: 2995-8067 | Quick Google Scholar

Next Full Text

Exit Schreiner Collection

Received 28 Aug 2024 Accepted 05 Sep 2024 Published online 06 Sep 2024

In recent years, manufacturing enterprises have faced overall financial stress due to market conditions and new forms of positive development. Excessive inter-company loans have led to the rupture of the capital chain among enterprises, resulting in developmental challenges. Studying the flow of funds between enterprises, it is observed that financial risks bear similarities to the spread of infectious diseases like SARS. This paper employs the MATLAB data analysis environment, Python data analysis tools, and the SEIRS dynamic time-varying epidemiological model to investigate systemic risk transmission among enterprises. The analysis reveals that high-risk transmission rates, low-risk immunity rates, and low-risk isolation rates contribute to the rapid and uncontrollable spread of systemic risks among enterprises. Consequently, recommendations are made to strengthen market supervision, government intervention, and national regulation to ensure the safety of manufacturing enterprises.

At the critical moment when the entire party and all the people of all ethnic groups in the country embark on a new journey to comprehensively build a socialist modernized country and march towards the second centenary goal, General Secretary Xi Jinping once again emphasized the need to focus on the real economy in economic development. This reflects the firm confidence of our party in maintaining steady progress in the economy and the strategic determination to address the current complex situation [1]. Themanufacturing industry is the focus of the real economy, accounting for 27.7% of the national economy in 2023, and 62.9% of the real economy, serving as its core source. As the core link of China's industrial system, while its comprehensive strength continues to increase, its ability to withstand risks should also be continuously enhanced.

From the high-interest loans in Liaocheng to the capital chain rupture of Qixing Group, and then to the short selling and bond dumping encountered by Weiqiao Group, the massive grey debt network in Shandong has been exposed, turning mutual loans from financing innovation into dirty means of "loan chaining." However, within the entire market, the relationships between manufacturing enterprises and various industries, especially the lending relationships with banks, are becoming increasingly complex, facing more and more risks [2]. Therefore, this paper proposes to study the risk transmission and prevention among manufacturing enterprises in China by analogy with infectious disease models. Understanding the propagation of financial risks among manufacturing enterprises in China and enhancing the prevention capabilities of manufacturing enterprises against risks is of great significance.

The changing nature of these risks affects the survival of manufacturing enterprises in the entire market environment. Once risks occur in manufacturing enterprises, financial risks spread rapidly and uncontrollably throughout the market environment, potentially leading to the sudden destruction of several years' worth of development in China's secondary industry market. Inter-company mutual loans and lending relationships between enterprises and banks contribute to a complex, furthermore, intricate webs of relationships.

Zhang Xinyan [3] established an SIRS model to study transmission and control of credit risks among supply chain enterprises. The study suggests that introducing elimination mechanisms, regularly assessing enterprise risks immunity, and strengthening risk management capabilities can effectively prevent enterprises from falling into financial risks arising from supply chain disruptions. Zhang Ruifeng and Li Xinqiu [4], among others, conducted similar research and concluded that an increase in the number of core enterprises can effectively control the diffusion of financial risks in the market environment. Mi and Qian Yuanyuan [5,6] studied digital financial risks of financial institutions by establishing an SEIS model, suggesting that the impact rate of financial risks exceeds recovery rate.

Manufacturing enterprises serve as the foundation of the real economy. To date, scholars from various fields have studied the complex and diverse problem of financial risk contagion among enterprises, but research specifically focused on manufacturing enterprises is scarce. Wu Yuhang [7] (2021) conducted research on financial risk measurement using the GARCH cluster-Copula-CoVaR model, finding that interactions between different entities mutually impact each other. Zhou Wenting and Feng Chen [8] used the Copula model to simulate inter-enterprise transactions and found that a crisis in one enterprise could trigger financial risks in the entire supply-production-sales system. Tan Liming [9] proposed applying the HD-TVP-VAR model to calculate network associations of financial institutions, analyzing the causes and transmission paths of risks. Wang Wensheng [10], Cui Huiying [11], Zhao Jiaqi [11], and others also conducted research using the same model. Sun Lihua [12] (2021) conducted separate studies on non-financial enterprises, suggesting the establishment of a debt risk assessment system for enterprises based on classification management to reduce debt risks.

Wang Jingqing [13] analyzed the channels of risk generation and transmission by establishing an evolving model of credit risk transmission networks. It is suggested to strengthen the credit reporting system to reduce the possibility of risk transmission. Similar conclusions were drawn by Yang Yang [14], Hou Lei [15], and others who conducted similar research. Liu Shuchun [16] addressed the gradual spread of "dual-chain" risks among Chinese enterprises and proposed several recommendations, including stabilizing loan issuance by banks to avoid "dual-chain" risks, removing leverage from potentially risky enterprises, timely and accurate control of excessive inter-enterprise guarantees by banks, and enhancing dynamic risk prevention and control among enterprises to prevent such problems. Wang Xudan [17] studied the guarantee situations of Zhejiang enterprises and governments, finding that risks on the guarantee chain are jointly generated by internal and external factors and spread through risk carriers such as orders. To reduce or mitigate risks, cooperation among the government, banks, and enterprises is necessary. This approach can be generalized to analyze similar situations in other regions and proactively prevent financial crises.

The analysis above indicates that domestic and foreign scholars have been studied financial risks for quite some time, primarily using the VAR, CCA, and Copula models, with limited research on manufacturing enterprises [18,19]. Only recently have scholars begun to gradually apply infectious disease models to the study of financial risks, but the main focus has been on systemic risk transmission among financial institutions. This paper utilizes the SEIRS model, which is more applicable to real-world situations and to studying various factors influencing the transmission of financial risks among manufacturing enterprises, taking into account enterprises in the latent period [20,21].

Manufacturing enterprises, as the foundation of the real economy, once the risk occurs, the stroke rise will be rapidly transmitted to other industries and even various countries and regions, resulting in global systemic financial risks.

Based on previous research, the mechanism of financial risk transmission is similar to that of infectious diseases such as SARS. Many experts and scholars both domestically and internationally have already applied infectious disease models such as SI, SIS, and SEIR to the study of financial risk transmission [22,23]. This paper adopts the SEIRS model to investigate how financial risks propagate within manufacturing enterprises.

Many scholars have found that the spread of financial risks has the same mechanism as the spread of infectious diseases, and they believe that the process of the beginning of the outbreak of financial risks and their disappearance is similar to that of infectious diseases, and that the spread, diffusion and demise of financial risks can be studied in the same way as natural infectious diseases. From the nature of the enterprise, whether it is state-owned enterprises, private enterprises or joint-stock enterprises, in all aspects of business and capital flow are closely related, if a single enterprise has financial problems leading to bankruptcy, its sister enterprises will also face the same situation, and ultimately the risk will spread to the entire industry. It can be seen that financial risk has the same spreading mechanism as infectious disease, so this paper adopts SEIRS model to simulate the risk spread of financial risk among manufacturing enterprises with practical value.

The model provides a more detailed and comprehensive description of the transmission of infectious diseases, and has a high degree of similarity with the intrinsic mechanism of risk transmission among manufacturing enterprises. In the process of transmission, financial risks among manufacturing enterprises may be transmitted among their subsidiaries and different upstream and downstream enterprises, thus affecting the operation of the whole manufacturing industry to different degrees. This feature is similar to the characteristics of the spread of this infectious disease.

The earliest infectious dynamics SI model consisted of only two roles: Susceptible individuals (S) and infected individuals (I). However, as individuals can recover from influenza infections, the simple SI model fails to meet analytical requirements. Thus, the susceptible-infected-recovered (SIR) model was introduced. Conventional infectious diseases exhibit a latent period, necessitating the addition of exposed individuals (E) to the susceptible-exposed-infected-recovered (SEIR) model, which captures the stages of exposure, infection, and recovery. Due to the strong variability of the influenza virus and the decreased immunity of recovered individuals, they remain susceptible to reinfection. Therefore, the susceptible-exposed-infected-recovered-susceptible (SEIRS) model is employed to analyze risk transmission.

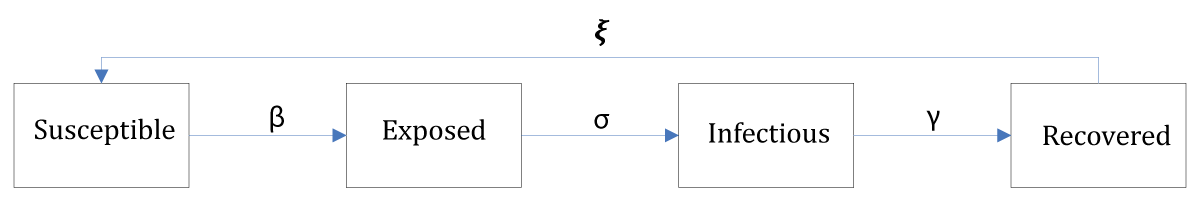

In normal operational conditions, manufacturing enterprises are classified as susceptible entities (S), also known as "healthy enterprises." Enterprises with fragile financial situations and significant external loans are classified as exposed entities (E). Enterprises experiencing a rupture in their capital chain while still in operation are classified as infected entities (I). Infected enterprises may eliminate risks and recover to become recovered entities (R) with the assistance of government policies, capital injections from other enterprises, or further loans from banks. However, if infected enterprises fail to secure sufficient funds to eliminate risks, they may declare bankruptcy, leading to bankruptcy liquidation by banks and courts, representing the "death" of the enterprise. After recovered entities eliminate financial risks and operate stably for a period, they are once again classified as susceptible entities (S) Figure 1.

In the model, ß (transmission rate) represents the speed of transmission, i.e., the rate at which susceptible enterprises become exposed; s (incubation period) denotes the time it takes for exposed enterprises to transition into infected enterprises; γ (recovery rate) signifies the probability of infected enterprises recovering from the infection. D represents the average duration of infection, and γ is the reciprocal of the average duration of infection (1/D).

𝝃 represents the time for immunity loss. The dynamics of the model over time are as follows (where N = S + E + I + R):

When R0 = 1 manufacturing inter-firm financial risk, will gradually disappear with the operation of the enterprise, but when R0 < 1, inter-firm financial risk will always exist.

This paper aims to construct a financial risk transmission model under the following assumption

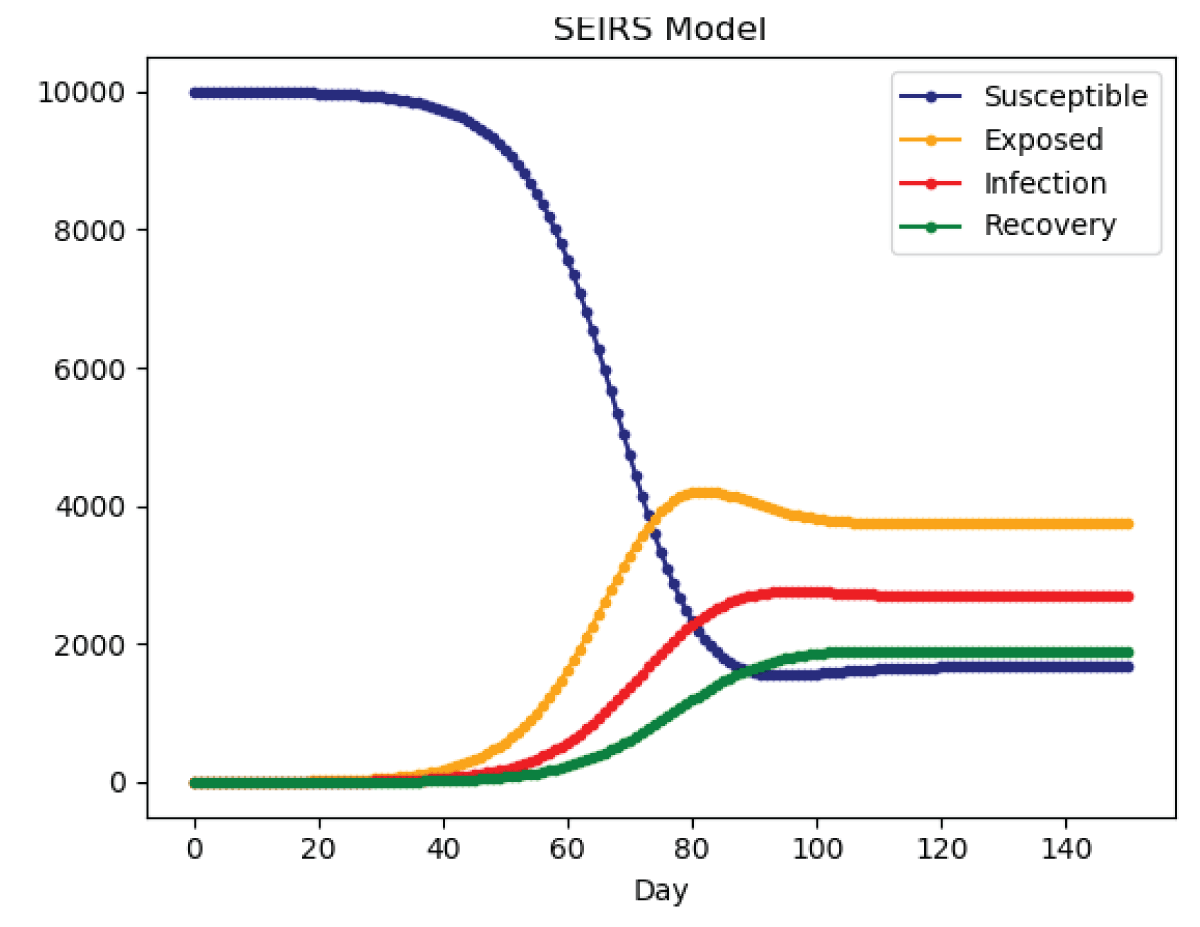

At the initial state, the system comprises 10,000 manufacturing enterprises with a transmission rate of 0.6 and a recovery rate of 0.1. Bankruptcy during the incubation period of enterprises lasts for 12 days, with an initial count of 1 enterprise in the incubation period, and no enterprises in the infection or recovery period. Enterprises that go bankrupt can resume operations again after a recovery period of 7 days. The entire simulation period spans 150 days Figure 2.

The above results illustrate the initial quantities and variations of each type of enterprise.

Initially, there is only one latent enterprise. By the 18th day, the number of exposed enterprises begins to raise, resulting in a precipitous decline in the number of susceptible enterprises. Financial risks propagate rapidly among enterprises due to weak capital chains. From the 70th to the 90th day, there is a small peak in the number of exposed and infected enterprises. At this point, government support policies and mutual assistance among enterprises begin to take effect, stabilizing the impact of risk transmission. As depicted in the graph, after the 100th day, the quantities of the four types of enterprises tend to stabilize.

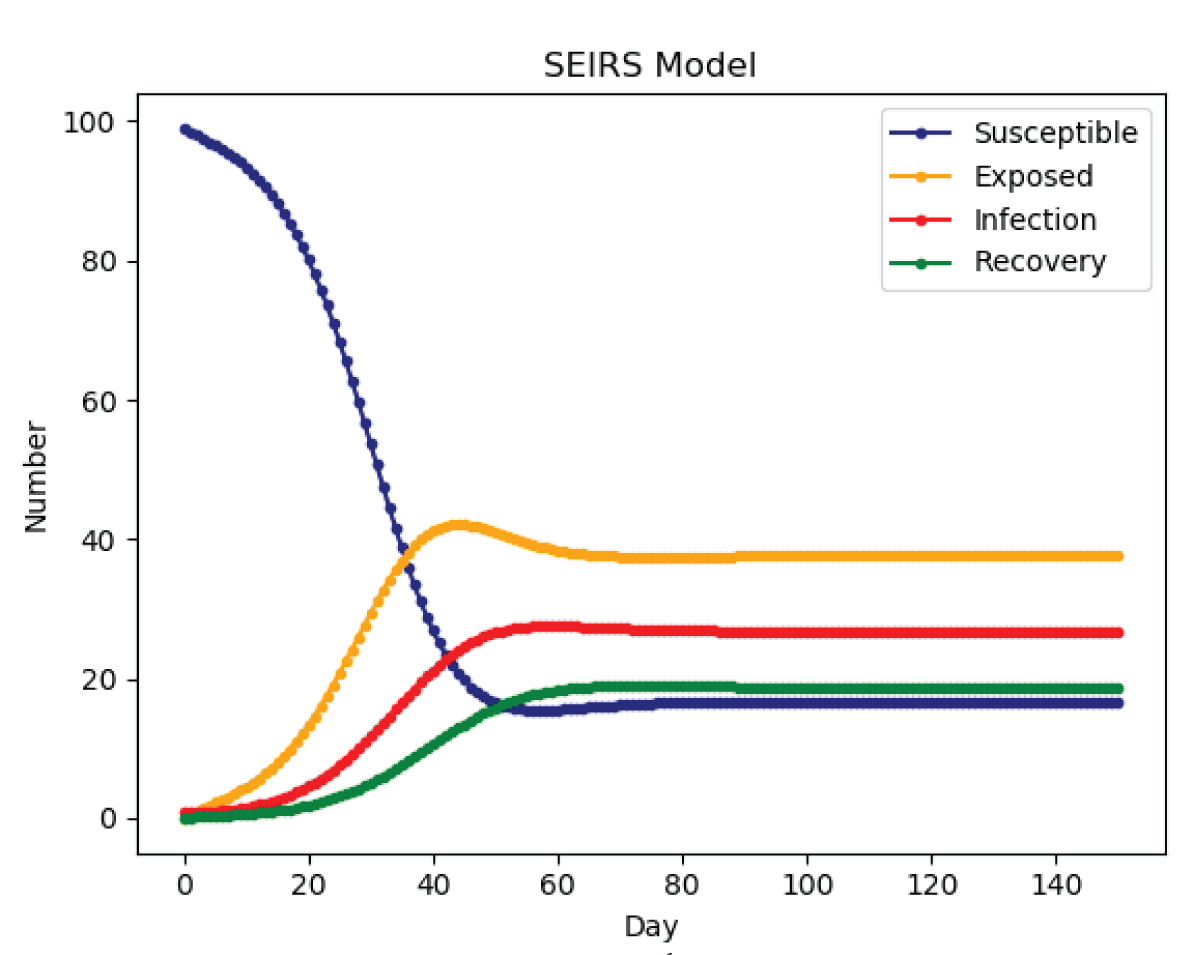

Reducing the number of enterprises within the specified range yields the effects depicted in the graph Figure 3.

In the same 150-day simulation period, when the number of enterprises is reduced to 100, the basic reproduction number R0>1 exceeds 1 from the first day, indicating the onset of financial risk transmission. At this point, some enterprises begin to experience issues such as the inability to recover receivables or pay off liabilities, leading to capital chain ruptures. However, in this simulation result, infected individuals persist and stabilize at over 20%, indicating that enterprises that have experienced an economic crisis find it difficult to return to normalcy within a short period.

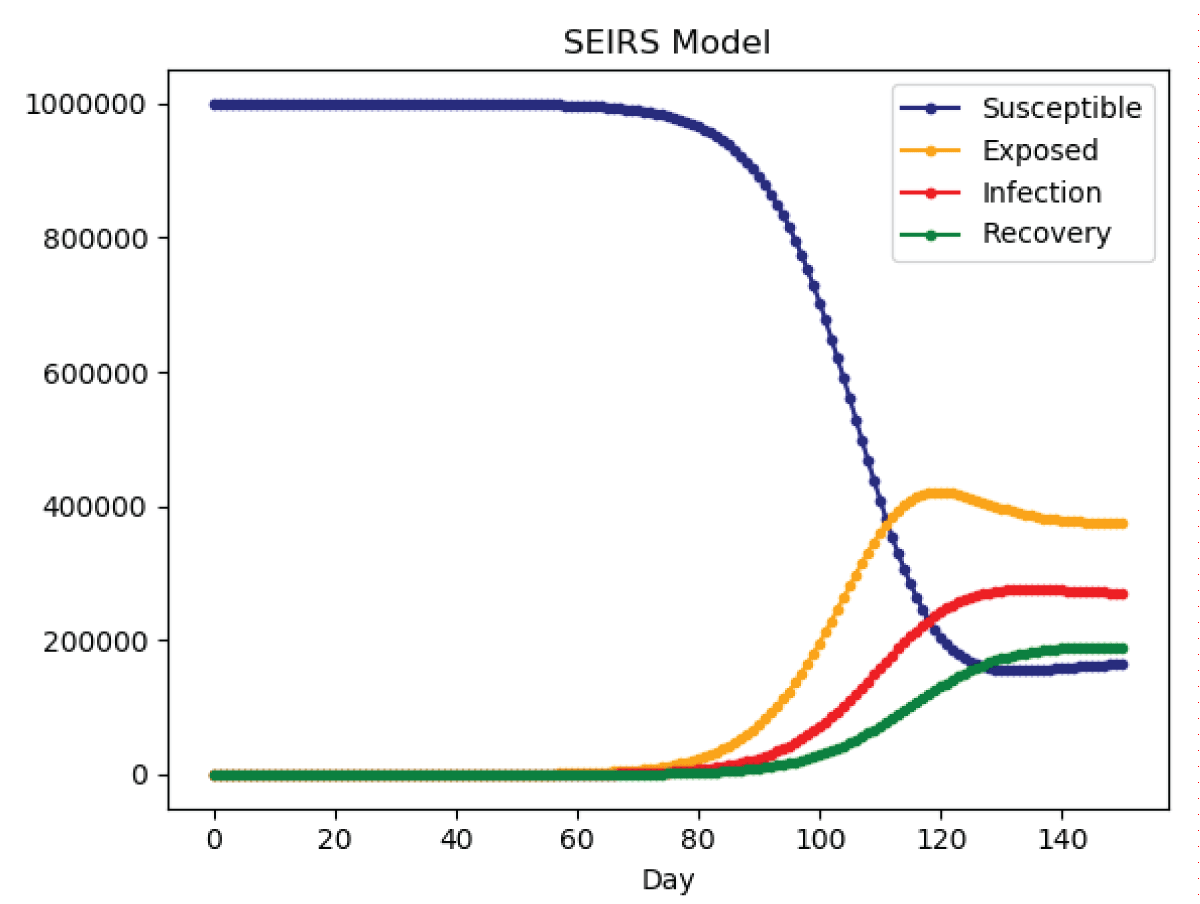

Increasing the number of enterprises within the specified range yields the effects depicted in the graph Figure 4.

In the same 150-day simulation period, when the number of enterprises is increased to 1,000,000, the quantities of enterprises in each state remain stable for up to 60 days before large-scale infections begin to occur.

There are many factors influencing the transmission of financial risks to other manufacturing enterprises, including but not limited to policy interference, risk transmission rate, risk incubation period, recovery period (time from infection to risk resolution), infection time, and immunity period. Next, we will analyze each relevant factor's impact on the transmission and influence of financial risks in manufacturing enterprises.

Simulating systemic risk in the banking system under changes in the risk transmission rate (national policies, central bank regulation).

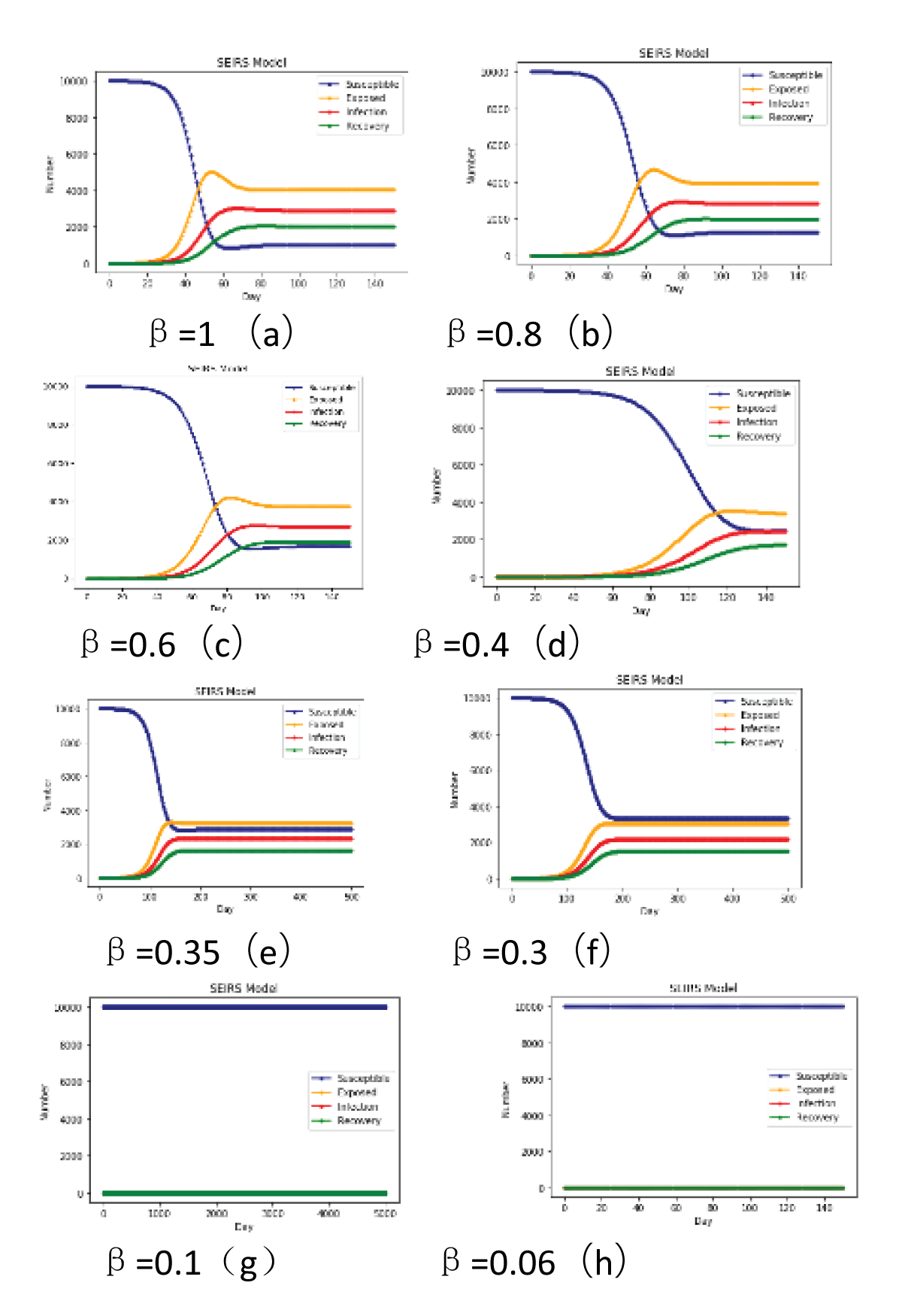

When the transmission rate varies, the numbers of enterprises in different states at the same moment are not the same. When the transmission rate ß is assigned values of 1(Figure 5a), 0.8(Figure 5b), 0.6(Figure 5c), and 0.4 (Figure 5d) respectively, the numbers of exposed, infected, and recovered enterprises all experience a peak during the ascending process. R0 remains greater than 1 continuously, then decreases to a certain extent and stabilizes, eventually reaching an equilibrium state. When the transmission rate ß is assigned values of 0.35(Figure 5 e) and 0.3(Figure 5f), the number of healthy enterprises plummets, while the number of infected enterprises continues to increase, and the number of banks infected by financial risks exhibits a spreading trend. However, when the transmission rate drops to 0.3(Figure 5g-h), with σ (incubation period), γ (recovery period), D (average infection time), and 𝝃 (time to lose immunity) maintaining conventional data without changes, the basic reproduction number R0 is less than 1. At this point, financial risks cannot continue to spread among manufacturing enterprises, and therefore, will not continue to propagate among enterprises. As time passes, the rate of risk infection rapidly decreases, and the number of enterprises at risk of infection tends to converge. With the risk infection rate dropping low enough, the entire market environment operates stably, greatly reducing the likelihood of major risks such as financial crises occurring.

Simulation of Systemic Risk in the Banking System under Changes in the Risk Incubation Period.

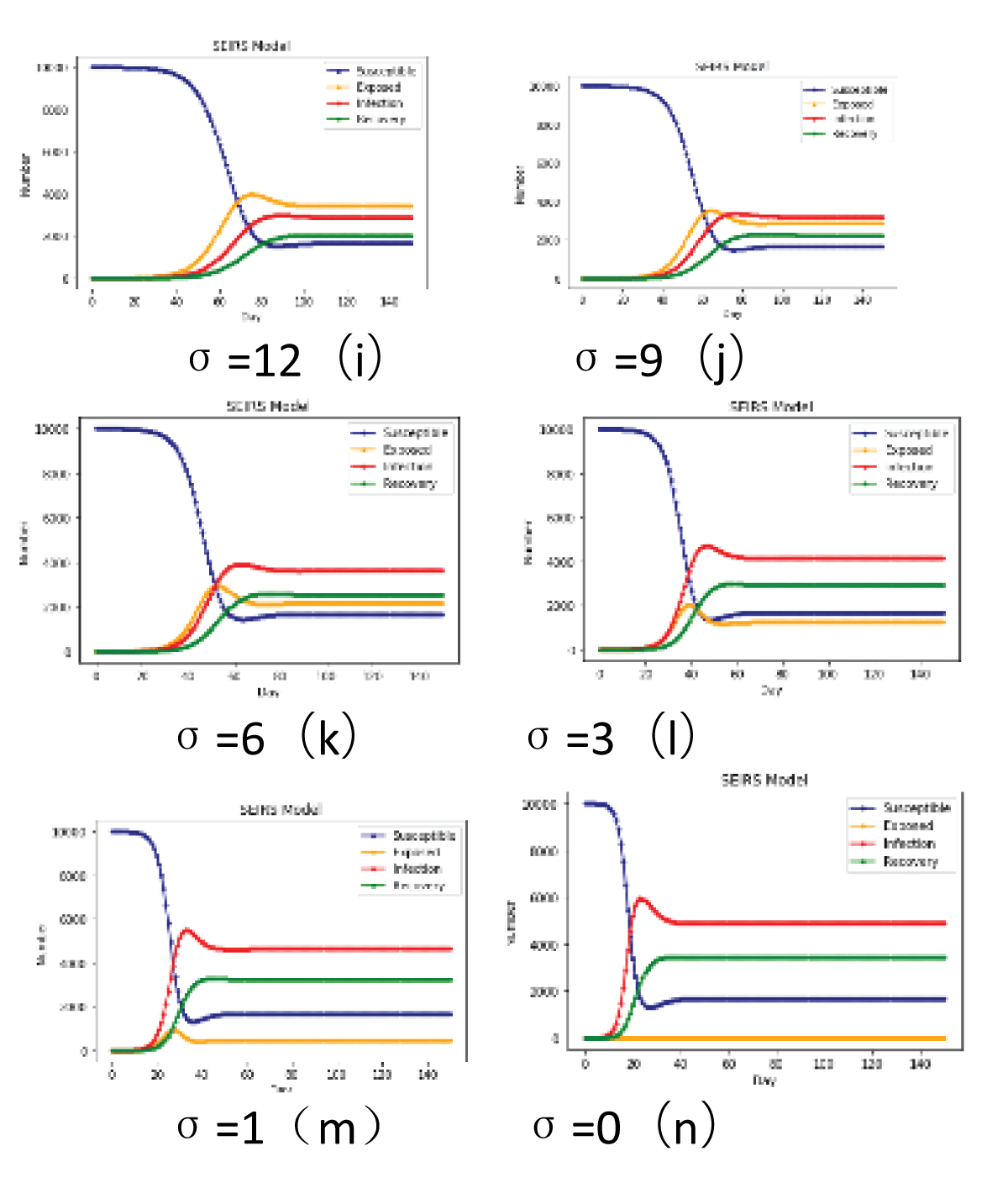

Keeping other factors constant, only the incubation period of affected enterprises is prolonged. When the incubation period is 0(Figure 6i-n), affected enterprises are immediately infected by financial risks. In this scenario, there is no time for reaction, making it even more difficult to receive external financial assistance, leading directly to a financial crisis. Moreover, with a larger number of infected risk-bearing companies, the market environment becomes chaotic, quickly escalating into a financial crisis across the entire market, with no possibility of recovery. As the incubation period increases, governments and banks establish comprehensive early warning mechanisms for risks in advance. Enterprises promptly detect impending financial risk infections, seek timely financial assistance, and utilize collateral and other rescue measures. Some enterprises manage to reverse the situation of imminent infection before succumbing to financial risks, thus reducing the likelihood of risk infection. Maintaining stable operations in the entire market environment is crucial. Therefore, it is evident that a comprehensive financial risk early warning mechanism and favorable support strategies are key to preventing enterprises from falling into financial risk.

Simulation of Manufacturing Enterprise Infection Risks under Changes in the Infection Recovery Period.

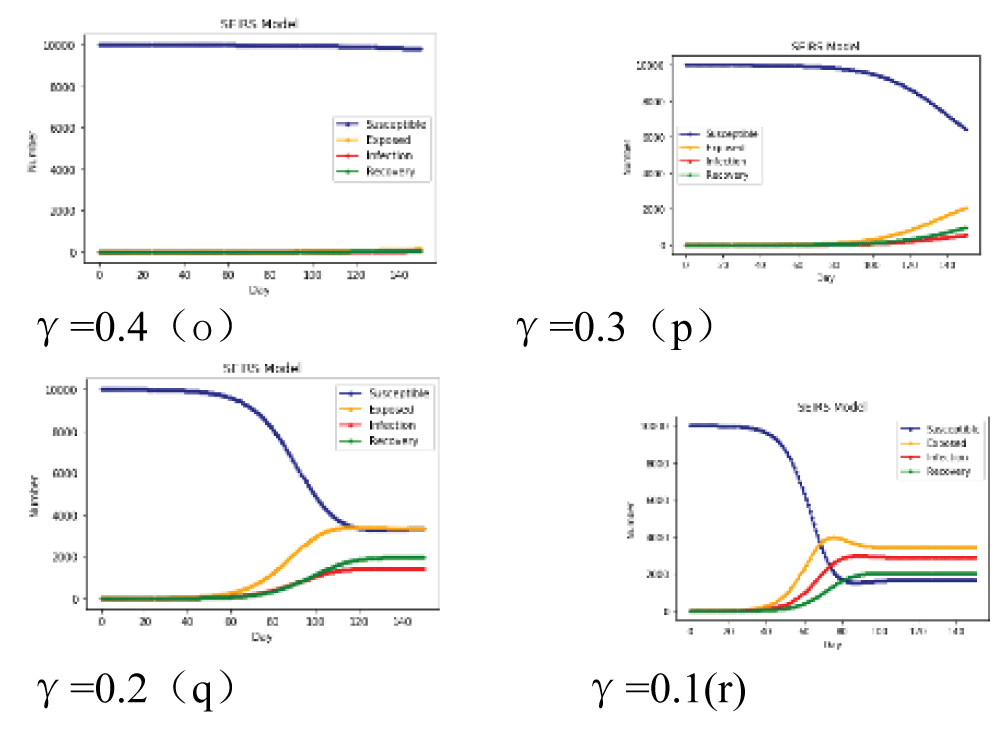

Gamma=1/D, keeping other parameters constant, γ takes values of 0.4(Figure 7o), 0.3(Figure 7p), 0.2(Figure 7q), and 0.1(Figure 7r) respectively. At this point, the calculated R0 value remains consistently below 1, indicating that the market environment tends to stabilize, and financial risk infections disappear. Under normal circumstances, a systemic risk across the entire environment is unlikely to occur. As depicted in the graph, when the recovery rate exceeds 0.4, the basic reproduction number R0 consistently remains greater than 1, making financial risks difficult to stabilize. The number of healthy enterprises tends to stop decreasing, while the number of infected risk-bearing enterprises tends toward 0. It is evident that the higher the recovery rate, the stronger the enterprise's resilience to risks, leading to a more stable market operating environment.

Simulation of Systemic Risk in the Banking System under Changes in the Risk Immunity Rate Figure 8.

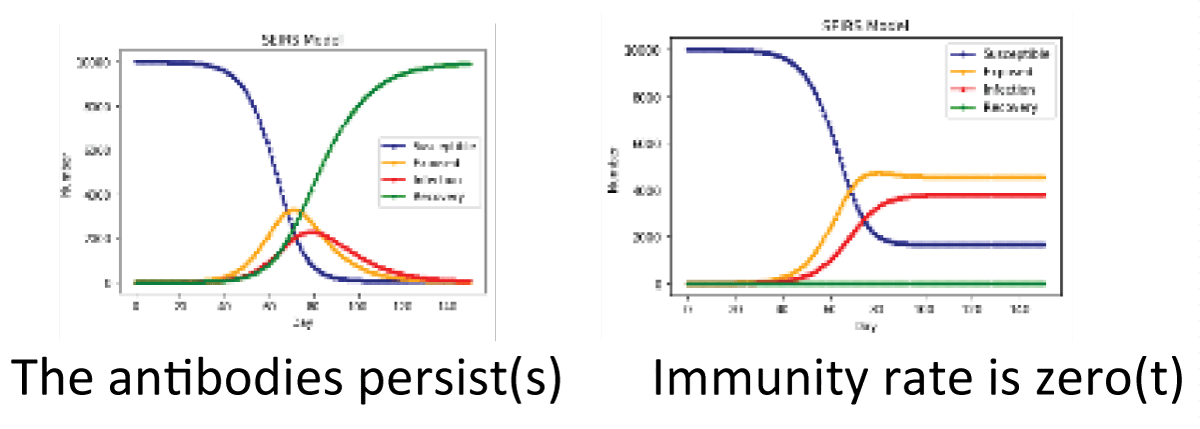

Keeping other parameters constant, the risk immunity time gradually decreases. The risk immunity rate refers to the time it takes for a recovered enterprise to return to a healthy state. During this period, both the government and banks provide certain protection and support to such enterprises. As the risk immunity time period shortens, the number of healthy enterprises decreases while the number of enterprises affected by financial risks increases. When the risk immunity time is set to 12, R0 transitions from being greater than 1 to less than 1 gradually. The number of enterprises affected by financial risks decreases, the growth rate of affected enterprises slows down, and stability is reached after a short period. When the risk immunity time is less than 3, the rate of reduction in healthy enterprises in the market environment slows down, while the rate of increase in the number of enterprises affected by financial risks accelerates, taking a long time to reach a stable state. As the risk immunity time approaches infinity, the basic reproduction number R0 becomes significantly less than 1, and healthy enterprises are severely impacted. Without absolute support from the government and banks, it will be difficult for them to recover normal operations, making the occurrence of an economic crisis in the market environment inevitable.

When the transmission rate ß, the latent period s, the recovery period γ, the average infection time D, and the loss of immunity time 𝝃 change in different directions, it is found that the risk transmission rate is the most significant factor affecting risk propagation among enterprises. With other influencing factors unchanged, the intensity of risk shocks increases with the increase in the risk infection rate. From the above analysis, it can be seen that financial risks naturally disappear when the risk transmission rate among enterprises is below 0.3. The contagion rate has the most obvious impact on the spread of financial risks among manufacturing enterprises, and it is almost impossible to rely solely on enterprises to voluntarily reduce the amount of co-policy or reduce the number of co-policy enterprises. Instead, it is necessary for the government to establish an effective regulatory mechanism and a financial risk assessment mechanism to protect the repayment of enterprises and the normal operation of enterprises to reduce the contagion rate, help each enterprise realize normal operation, and reduce financial risks. Transmission among manufacturing enterprises.Next is the risk immunity rate. Under the optimal conditions of other factors, the higher the risk immunity rate, the lower the probability of a financial crisis occurring in the market environment. When the immunity time exceeds 3, financial risks will not occur.

Then there is the latent period. The longer the latent period, the more time and opportunities there are to fill the gaps in enterprise funding. Both policy support and loan supplementation can urgently prevent the occurrence of financial risks. Latent period in the financial risk of manufacturing enterprises for the impact of the obvious, to strengthen the daily work of supervision and control work, the establishment of strict norms of the work of the link to supervise the enterprise personnel strictly in accordance with the rules and regulations of the work of the existence of tendency problems, timely rectification, to reduce the rate of contagion, enhance the level of internal control of the enterprise.

Finally, the risk recovery rate of infection. When enterprises are affected by risks and recover, various funds and policies come one after another. At this time, banks and governments isolate and protect them, which helps newly recovered enterprises avoid the risk of infection from other affected enterprises, thereby maintaining the stability of the market operating environment.

In summary, to eliminate financial risks in enterprises and reduce the number of zombie enterprises and bankruptcies, it is particularly important to establish a sound financial risk early warning system and enhance enterprise protection measures.

The contagion rate has the most obvious impact on the spread of financial risks among manufacturing enterprises, and it is almost impossible to rely solely on enterprises to voluntarily reduce the amount of co-policy or reduce the number of co-policy enterprises. Instead, it is necessary for the government to establish an effective regulatory mechanism and a financial risk assessment mechanism to protect the repayment of enterprises and the normal operation of enterprises so as to reduce the contagion rate, help each enterprise realize normal operation and reduce financial risks. Transmission among manufacturing enterprises.Insights and Recommendations

This paper, by establishing an SEIRS infectious disease model, simulates the transmission of financial risks among similar enterprises and finds that the transmission of risks is influenced by multiple factors such as the transmission rate, latent period, recovery period, average infection time, and loss of immunity time, each with varying degrees of impact. Preventing enterprises from falling into financial crises is the least costly improvement measure, with enterprise operations being of paramount importance. In order to prevent risk contagion more effectively and efficiently in the market environment, the following recommendations will be provided based on the arguments and analysis presented in this paper:

Prudent regulatory tools should permeate each other. At the micro level, enterprises should improve financial data, establish sound operational risk warning mechanisms internally, and strictly adhere to national policy directives. At the macro level, manufacturing enterprises should be categorized and supported based on data extraction, with potential and borderline enterprises receiving support and optimization to increase the number of high-quality enterprises. This will enhance the transmission of financial risks among enterprises, thereby reducing systemic financial risk contagion rates, transmission speeds, and infection scales. Starting with national policies, establish enterprise stress testing systems and financial risk early warning mechanisms. Based on the existing banking regulatory framework, improve the dynamic changes in enterprise operating data and strengthen supervision over enterprise operating data. Banks and the Ministry of Industry and Information Technology should jointly establish a system for monitoring enterprise operating conditions, optimize regulatory measures and intensity for enterprises, reduce enterprise financial risk contagion rates, extend the infection incubation period, and shorten the recovery period for enterprises that have resumed normal operations, thereby maintaining the stability of most enterprises' operations. Macro supervision adopts a top-down policy mechanism, mainly aimed at ensuring the normal operation of enterprises and preventing risk contagion between enterprises. Micro supervision is a bottom-up prevention and warning mechanism that can only ensure the stable operation of a single enterprise but cannot guarantee the normal operation of the entire group of enterprises. Therefore, it is necessary to integrate the two mechanisms of macro and micro supervision so that every enterprise in the group can operate normally.

Firstly, assess enterprises that have fallen into financial risk, analyze the types and degrees of risk they face, and take different support measures for enterprises of different risk types. Then, analyze the current situation of enterprises that need support, whether banks, the Ministry of Industry and Information Technology, and other departments have the ability to assist such enterprises. If they have the ability to assist such enterprises, considerations should be made to prevent other enterprises from imitating them and generating credit crises and risk diffusion crises. If there is no ability to assist such enterprises, whether the bankruptcy of such enterprises will spread financial risks to the entire industry should be considered. Only by treating different situations differently can enterprises at risk be rescued, and secondary damage caused by risk diffusion to the enterprise be reduced. Establishing an after-the-fact remediation mechanism is a key factor in preventing risk transmission.

There are economic transactions between enterprises. In supply chain enterprises, if upstream enterprises encounter financial difficulties, downstream enterprises face the risk of broken funding chains. Additionally, in horizontal enterprises, if one enterprise applies for bankruptcy due to a broken funding chain after borrowing from a bank, other brother enterprises are also likely to face the risk of broken funding chains and eventual bankruptcy. It can be seen that the development of risks in a single enterprise into systemic risks and their large-scale spread are similar to infectious diseases. Through technologies such as big data and artificial intelligence, the credit risks of small and medium-sized enterprises can be evaluated more accurately, and more competitive financing rates can be provided to them. By empowering digitization, financial resources can be directed to private and micro-enterprises, effectively solving the financing difficulties of small and medium-sized enterprises in batches, obtaining funding quickly, shortening the financing cycle, thus extending the incubation period of enterprise financial risks, and reducing the financial risk infection rate. When considering the complexity and dynamics of the market environment comprehensively, government intervention should be seen as a last resort. Under normal circumstances, the market should rely on its internal mechanisms to adjust and achieve the effectiveness of resource allocation. The government's role should mainly focus on establishing fair market rules and maintaining the order of competition, rather than directly intervening in market activities frequently. In this way, healthy market development can be promoted, while safeguarding the overall social welfare.

Ming W, Xuefeng X, Lnzi T, Ning S. Risk Contagion Effects of Interconnected Manufacturing Enterprises. IgMin Res. September 06, 2024; 2(9): 759-767. IgMin ID: igmin244; DOI:10.61927/igmin244; Available at: igmin.link/p244

Anyone you share the following link with will be able to read this content:

1Beijing Information Science and Technology University, School of Management Science and Engineering, Beijing, China

2Beijing Information Science and Technology University, Business School, Beijing, China

Address Correspondence:

Xiao Xuefeng, Beijing Information Science and Technology University, Business School, Beijing, China, Email: [email protected]

How to cite this article:

Ming W, Xuefeng X, Lnzi T, Ning S. Risk Contagion Effects of Interconnected Manufacturing Enterprises. IgMin Res. September 06, 2024; 2(9): 759-767. IgMin ID: igmin244; DOI:10.61927/igmin244; Available at: igmin.link/p244

Copyright: © 2024 Ming W, et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Figure 1: SEIRS Model Transmission Diagram....

Figure 1: SEIRS Model Transmission Diagram....

Figure 2: Curve0 Initial state....

Figure 2: Curve0 Initial state....

Figure 3: Curve1 Reduce the number of businesses....

Figure 3: Curve1 Reduce the number of businesses....

Figure 4: Increase the number of businesses....

Figure 4: Increase the number of businesses....

Figure 5: Changing the Beta-β....

Figure 5: Changing the Beta-β....

Figure 6: Changing the Incubation Period....

Figure 6: Changing the Incubation Period....

Figure 7: Changing the infection recovery period....

Figure 7: Changing the infection recovery period....

Figure 8: Changing the risk immunity rate....

Figure 8: Changing the risk immunity rate....